schedule c tax form meaning

A Schedule C form is a tax document filed by independent workers in order to report their business earnings. The resulting profit or loss is typically considered self-employment income.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

You are involved in the activity with continuity and regularity.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. As you can tell from its title Profit or Loss From Business its used to report both income and losses. What is Schedule C.

View solution in original. This Schedule provides a recap of your companys income and expenses. The Schedule C is an IRS form that collects data about your small business and then calculates your net profit.

This is the amount the IRS taxes not your income. Schedule C is the tax form that independent contractors and many small business owners use to report their business income. Ad Download or Email IRS 1040 SC More Fillable Forms Register and Subscribe Now.

If you dont need the description you can delete that miscellaneous expense. Ad E-file sole proprietor taxes for your business for free. Your primary purpose for engaging in the activity is for income or profit.

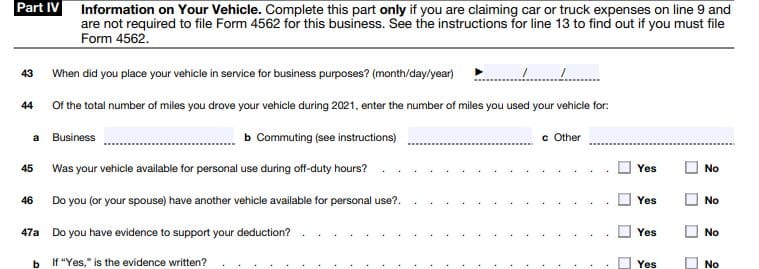

Schedule C allows for multiple income allocation types when reporting your earnings. An accounting method is the method used to determine when you report income and expenses on your return. This can encompass owning a digital or brick-and-mortar small business freelancing contracting and gig work such as ride-share driving.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. Amounts reported from Form 1099-K or in box 7 of your 1099-Misc will carry to your Schedule C as Gross Income. The profit is the amount of money you made after covering all of your business expenses and obligations.

Schedule C is used by small business owners and professionals who operate as sole proprietors to calculate their profit or loss for the tax year. Schedule C is a schedule to Form 1040 Individual Tax Return. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

That essentially includes anything you did to earn new business or increase sales to past customers that you cant categorize elsewhere. Its important to note that this form is only necessary for people who have had income reported on 1099 forms meaning they are considered contract employees rather than full employees of the company or organization contracting them. Its used to report profit or loss and to include this information in the owners personal tax returns for the year.

IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business. Many times Schedule C filers are self-employed taxpayers who are just getting their businesses started. In 2018 the last year reported more than 27 million small business owners filed their tax returns using Schedule C.

A net profit or loss figure will then be calculated and then used on the proprietors personal income tax return on form 1040. Find the miscellaneous expense that doesnt have an amount next to a description. Gross Income - Income recognized from services provided.

Usually if you fill out Schedule C youll also have to fill out Schedule SE Self-Employment Tax. 0 federal for everyone. If you receive a Form 1099-MISC 1099-NEC andor 1099-K you are likely to have to report it on Schedule C along with other.

Schedule C is the form used to report income and expenses from self-employment. Typically a sole proprietor files their personal and business income taxes together on one return. Click Edit next to your business.

Click Review next to Other miscellaneous expenses. On the other hand the accrual method accounts for revenue when it is earned and expenses goods and services when they are incurred. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Schedule C is the tax form filed by most sole proprietors. Its part of your personal tax return. Click EditAdd next to your business.

What is Schedule C-EZ. Otherwise enter an amount. The revenue is recorded even if cash has not been received or if expenses have been incurred but no cash has been paid.

An activity qualifies as a business if. Schedule C - Accounting Method. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

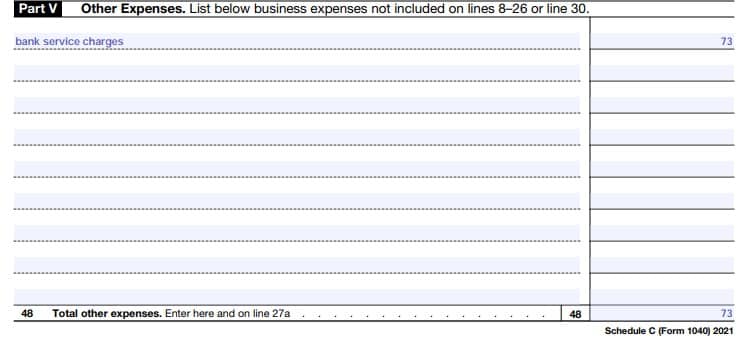

You must use the same accounting method from year to year. Schedule C is used to report profits and losses from a business. You can put the expenses for all forms of advertising under Line 8 in Part II Expenses of Schedule C.

An accounting method is chosen when you file your first tax return. If you wish to change your accounting method you need permission from the IRS. Accrual accounting is the most common method used by businesses.

An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity. Pulled to Part I Line 1. Complete IRS Tax Forms Online or Print Government Tax Documents.

Some examples of tax-deductible advertising expenses include. That profit or loss is then entered on the owners Form 1040 individual tax return and on Schedule SE which is used to calculate the amount of tax owed on earnings from self-employment. Over 50 Million Returns Filed 48 Star Rating Claim all the credits and deductions.

Business Activity Code For Taxes Fundsnet

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

How To Fill Out Your 2021 Schedule C With Example

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

How To Fill Out Your 2021 Schedule C With Example

Form 1040 U S Individual Tax Return Definition Tax Forms Income Tax Return Irs Tax Forms

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

What Do The Expense Entries On The Schedule C Mean Support

What Do The Expense Entries On The Schedule C Mean Support

Will I Get Audited If I File An Amended Return H R Block